does instacart automatically take out taxes

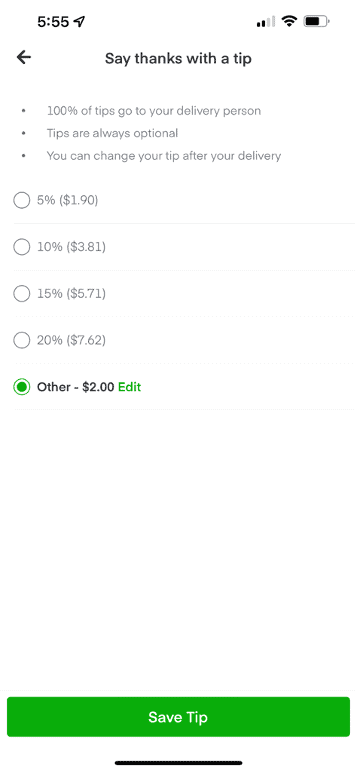

That means youd only pay income tax on 80 of your profits. However customers can give their shoppers cash tips if they wish.

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

I worked for Instacart for 5 months in 2017.

. This is a standard tax form for contract workers. I heard that you have to report after earning 600. None of this fee will go towards your driver.

Use Receipt Reward Apps. But the entire time Instacart has operated in the District it has failed to collect sales tax on the service fees and delivery fees it charged users the AG maintains. This can make for a frightful astonishment when duty time moves around.

Does Instacart take out taxes for its employees. You see there are numerous apps out there that pay you with PayPal cash or free gift cards in exchange for buying products from partner brands and uploading receipts as proof of purchase. Sales tax and a driver tip are not included in this 5 percent.

Does Instacart Take Out Taxes For All Employees. Instacart does not take out taxes at the time of purchase. I got my 1099 and I have tracked all my mileage and gas purchases but what else do I need to do before I file.

If you are an independent contractor for Instacart follow the link here to find out more information regarding the deductions that can be claimed. For simplicity my accountant suggested using 30 to estimate taxes. There are a few different taxes involved when you place an order.

Plan ahead to avoid a surprise tax bill when tax season comes. Fortunately you can still file your taxes without it and regardless of whether or not you receive a 1099-NEC you must still file taxes with the IRS. What Happens if I Dont File Instacart Taxes.

Instacart states that this service fee helps support the Instacart platform by covering operational costs including background checks insurance and customer support. To learn more about how you can. Is it per app or for you as the independent contractor.

Instacart doesnt accept cash payments for groceries fees or Express memberships in 2022. As youre liable for paying the essential state and government income taxes on the cash you make delivering for Instacart. Deductions are important and the biggest one is the standard mileage deduction so keep track of.

Your earnings exceed 600 in a year According to Instacart if you dont meet this requirement you wont receive a 1099-NEC. Instacart doesnt take taxes out because its a contractor job which is understandable but what do yall do around tax season. Because Instacart shoppers are contractors the company will not take taxes out of your paycheck.

Depending on your location the delivery or service fee that you pay to Instacart in exchange for its service may also be subject to tax. It will take all of that and figure out the percent for you. All companies including Instacart are only required to provide this form if they paid you 600 or more in a given tax year.

The estimated rate accounts for Fed payroll and income taxes. The other form of payment is done on Wednesdays where all past weeks work is paid through the employees. What percentage of my income should I set aside for taxes if Im a driver for Instacart.

You would face the same penalties as any other business that doesnt file taxes. This used to be reported to you on a 1099-MISC but that changed starting in 2020. The total amount including all applicable taxes will become charged to your payment method.

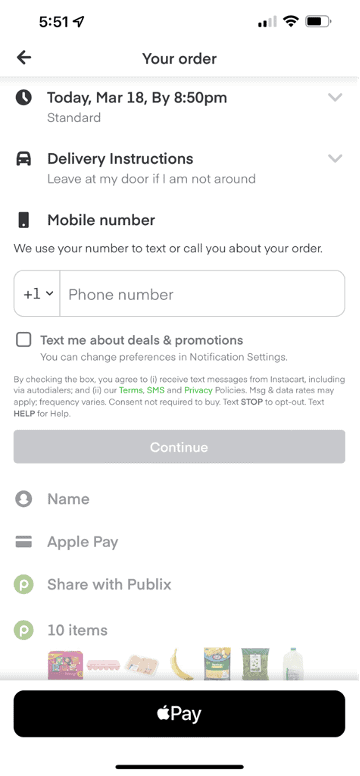

Instead Instacart accepts most major credit and debit cards and some forms of third-party digital payment as well as EBT SNAP through some retailers. You wont send this form in with your tax return but you will use it to figure out how much business income to report on your Schedule C. Then if your state taxes personal income youll need to find out the tax rate for your state and withhold accordingly in addition to the 20 minimum for your federal taxes.

Thats why I like the flat 25. Should I just save half of my pay. The tax andor fees you pay on products purchased through the Instacart platform are calculated the same way as in a physical store.

What do yall do about taxes. Instead full-service shoppers are considered contract workers and they must file a 1099 form with the IRS during tax season. Indeed if your earnings in Instacart is above 600 per tax year you will receive a 1099-MISC tax form.

You dont get the QBI deduction on the 153 in self-employment taxes. Instacart does not take out taxes for independent contractors. One sneaky Instacart shopper trick is to scan your shopper receipts with a variety of reward apps.

For most Shipt and Instacart shoppers you get a deduction equal to 20 of your net profits. The taxes on your Instacart income wont be high since most drivers are making around 11 every hour. Under District law Instacart has been responsible for collecting sales tax on the delivery services it provides.

To make saving for taxes easier consider saving 25 to 30 of every payment and putting the money in a different account. I want to do apps like UberEats Instacart Shipt etc. Estimate what you think your income will be and multiply by the various tax rates.

This can be a complicated subject so lets untangle topics like how to file taxes for Instacart work. Additionally the AG alleges that Instacart violated District. To pay your taxes youll generally need to make quarterly tax payments estimated taxes.

You dont send the form in with your taxes but you use it to figure out how much to report as income when you file your taxes. The problem is that they do not automatically take out taxes. Tax Deductions You Can Claim As An Instacart Driver Being classified as a business owner allows you to deduct your business-related expenses and avoid paying taxes on your 1099 earnings.

Dont make it so involved that you wont do it. June 5 2019 247 PM. 20 minimum of your gross business income.

Side note Im an idiot who didnt want to pay taxes out of pocket so I canceled 10 Instahours and decided to Instaquit. When using these feature payments get to you debit card automatically. Can you deduct your retirement contributions.

Except despite everything you have to put aside a portion of the. However in-store shoppers are Instacart employees taxes are taken out of their pay and they file W-2s in 2022. Like in Step 2.

By writing off expenses that deals with your driving service you can lower your taxable income and pay less taxes. Report Inappropriate Content. Dont touch a penny until youve pulled money out for your taxes.

Missouri does theirs by mail. If you make more than 600 per tax year theyll send you a 1099-MISC tax form.

How Much Can You Make A Week With Instacart 2022 Real Earnings

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Ipo What You Need To Know Forbes Advisor

How Does Instacart Work And How Much Does It Cost

How Does Instacart Work And How Much Does It Cost

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

How Do Instacart Shoppers Make Tips Quora

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Postmates Vs Instacart 2022 Which Side Hustle Is Best For Drivers

Uhhhhhh Who S Making 63 000 Dollars On Instacart R Instacartshoppers

Uber Driver Car Door Advertisement Magnet Sign Zazzle Com Uber Driver Car Car Door

How Much Money Can You Make With Instacart Small Business Trends

Do Instacart Shoppers See Tips Before Delivery

Instacart Help Center Account Information

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

How Does Instacart Work And How Much Does It Cost

How Much Do Instacart Shoppers Make The Stuff You Need To Know

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Taxes The Complete Guide For Shoppers Ridester Com